The Distributional Consequences of Bitcoin Paper from European Central Bank Economists

"The Distributional Consequences of Bitcoin" (ECB Paper)

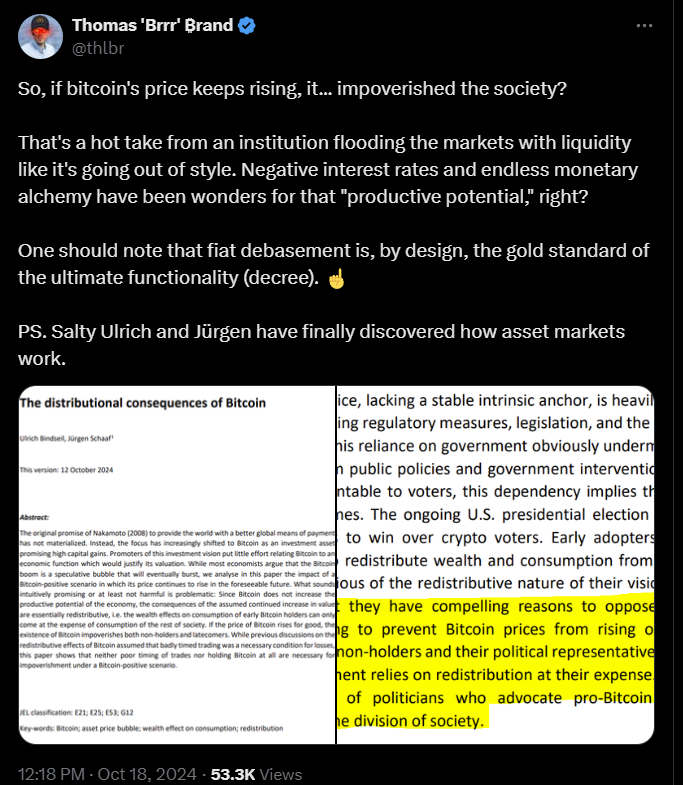

Economists from the European Central Bank released a paper describing their view of the economic consequences if Bitcoin adoption continues to rise.

1. Bitcoin’s Failure as a Payment System

- Claim: Bitcoin, as originally envisioned by Satoshi Nakamoto, was supposed to be a decentralized payment system, but this has not materialized. Bitcoin has not been significantly adopted for real-world, legal transactions.

- Support: The paper cites El Salvador, where Bitcoin was declared legal tender in 2021, but its use in everyday transactions has been minimal. The Chivo Wallet, meant to facilitate Bitcoin payments, operates on a centralized system, undermining the decentralized promise of Bitcoin.

"Even 16 years after its inception, real Bitcoin payments, i.e. effectively ‘on-chain’, are still cumbersome, slow, and expensive. Moreover, its value is considered too volatile to fulfil the classic functions of money."

2. Volatility and Speculation

- Claim: Bitcoin's price volatility makes it unsuitable as a reliable store of value or medium of exchange. This volatility benefits speculators and harms latecomers.

- Support: The authors reference Bitcoin's dramatic price swings, including its 80% drop during the 2021-2022 crypto winter, as evidence of its instability. They argue that Bitcoin’s current market valuation is a speculative bubble likely to burst.

"Bitcoin’s price has been on an unprecedented rollercoaster ride, with interim price gains of 1,000%... but also losses of almost 80% during the ‘crypto winter’."

3. Redistributive Wealth Effects

- Claim: Bitcoin’s rising price redistributes wealth unfairly, concentrating it among early adopters at the expense of non-holders and latecomers, creating a zero-sum game.

- Support: The paper suggests that as Bitcoin prices rise, wealth is shifted to early adopters, while non-holders face impoverishment through indirect effects like price inflation. It further posits that even individuals who never hold Bitcoin can be negatively affected by its rise.

"The existence of Bitcoin impoverishes both non-holders and latecomers... redistribution takes place that benefits those who time their trades well... at the expense of those with poor timing."

4. No Productive Economic Contribution

- Claim: Bitcoin does not contribute to the productive capacity of the economy because it generates no cash flows or tangible goods.

- Support: The authors compare Bitcoin to traditional financial assets such as real estate, stocks, and bonds, all of which generate income or dividends. They argue that Bitcoin’s value is based purely on speculative demand without any underlying economic fundamentals.

"Bitcoin lacks the traits of established financial assets. It does not generate any cash flow, interest, or dividends... most established ways of calculating or estimating the fair value of an asset fail when applied to Bitcoin."

5. Environmental and Social Harm

- Claim: Bitcoin’s proof-of-work (PoW) consensus mechanism leads to excessive energy consumption, causing environmental and social harm.

- Support: The authors refer to previous analyses highlighting the high electricity use associated with Bitcoin mining and its corresponding environmental impact. They also point to social inequality stemming from Bitcoin’s uneven distribution.

"The energy consumption and implied ecological and social damage caused by Bitcoin mining have been pointed out by many scholars."

6. Political and Lobbying Influence

- Claim: The cryptocurrency industry exerts disproportionate influence on U.S. politics and regulation through aggressive lobbying, which skews regulatory policy in favor of crypto assets.

- Support: The authors claim that the crypto sector, though still small, has dramatically increased its lobbying spending, particularly in the U.S. presidential election cycle. This activity is viewed as disproportionately influencing policy to legitimize Bitcoin.

"The number of crypto lobbyists almost tripled from 115 in 2018 to 320 in 2021, representing nearly half of all corporate election spending in the current cycle."

"Challenging Bias in the ECB's Bitcoin Analysis" (Rebuttal)

Murray Rudd, Allen Farrington, Freddie New, and Dennis Porter released their own paper refuting many of the ECB economists' claims.

1. Misrepresentation of Bitcoin’s Role

- Claim: The ECB misrepresents Bitcoin as merely a speculative asset and payment system failure. Instead, Bitcoin has naturally evolved into a decentralized store of value, in line with Satoshi Nakamoto’s vision.

- Support: The authors argue that Bitcoin's decentralized nature and scarcity align it more with a store of value like gold rather than a typical payment system. They suggest that the ECB ignores the evolution of Bitcoin’s primary function, especially after the 2017 Blocksize Wars, which prioritized security and decentralization.

"The authors misunderstand Bitcoin’s evolution... Satoshi Nakamoto highlighted Bitcoin’s potential as a hedge against central banking policies, stating early on that 'it might make sense to get some in case it catches on.'"

2. Wealth Distribution and Concentration

- Claim: The ECB’s assertion that Bitcoin’s wealth is highly concentrated among a few individuals is misleading. In reality, ownership is becoming more distributed, especially through exchanges and ETFs.

- Support: The rebuttal cites examples of widespread Bitcoin ownership in countries like Canada and the UK, where up to 10% of adults have invested in crypto. It also highlights that large Bitcoin wallets often belong to exchanges that hold assets on behalf of millions of users.

"Institutional and retail investors have increased their level of participation... BlackRock recently reported that 80% of its Bitcoin ETF buyers had never owned an iShare before."

3. Bitcoin as a Technological Innovation

- Claim: Bitcoin’s rise has spurred significant financial innovation, particularly in decentralized finance and remittances, which lower costs and improve financial efficiency.

- Support: The authors mention innovations like the Lightning Network, which facilitates nearly cost-free international remittances, reducing costs for the poorest populations, especially in developing economies.

"Bitcoin’s Lightning Network... reduces the need for traditional banking intermediaries, lowering transaction costs and improving economic efficiency, especially for international remittances."

4. Environmental and Social Benefits

- Claim: Contrary to the ECB’s argument, Bitcoin mining is moving towards environmentally friendly solutions, including the use of renewable energy and waste gases.

- Support: The authors provide examples of Bitcoin miners using renewable energy sources and landfill gas to power mining operations. They also highlight the social benefits of Bitcoin in oppressive regimes, where it offers financial lifelines.

"Bitcoin mining using waste landfill gas can mitigate methane emissions... Bitcoin’s decentralized nature provides financial lifelines in oppressive regimes."

5. Economic Contributions and Innovation

- Claim: Bitcoin contributes to long-term economic productivity by fostering financial innovation and serving as a neutral, decentralized form of money that counters capital misallocation caused by fiat systems.

- Support: The rebuttal stresses that Bitcoin, much like gold, provides value as a store of wealth in times of monetary instability. It also highlights Bitcoin’s ability to catalyze technological advancements in cryptography and energy efficiency.

"Bitcoin offers a hedge against inflation and monetary instability, serving as an alternative store of value similar to gold. Its fixed supply makes it resistant to fiat currency devaluation."

6. Critique of Political and Regulatory Framing

- Claim: The ECB’s focus on Bitcoin’s supposed political influence is exaggerated and biased, especially given the institution's own interest in developing CBDCs.

- Support: The rebuttal critiques the ECB’s framing of Bitcoin as a lobbying threat while ignoring the much larger influence of traditional financial institutions on regulatory policy. It asserts that Bitcoin has no central authority, and its decentralized nature contrasts with the institutional power of CBDCs.

"Framing Bitcoin lobbying as a unique threat is misleading... Bitcoin is a neutral, global, leaderless protocol with no CEO, marketing, or legal departments."

TLDR

Comparison of Key Claims

-

Role and Purpose:

- ECB: Bitcoin is a speculative investment that has failed as a payment system.

- Rebuttal: Bitcoin’s role has shifted from a payment system to a store of value, akin to gold, and this shift aligns with decentralized principles.

-

Wealth Redistribution:

- ECB: Bitcoin enriches early adopters, leading to economic inequality.

- Rebuttal: Bitcoin ownership is becoming more distributed, especially through exchanges, and it operates as a fair market where anyone can participate.

-

Economic Value:

- ECB: Bitcoin does not contribute to the productive economy, serving only speculative purposes.

- Rebuttal: Bitcoin drives innovation in decentralized finance, cross-border payments, and energy efficiency, contributing to economic growth.

-

Environmental Impact:

- ECB: Bitcoin’s proof-of-work mining is environmentally harmful.

- Rebuttal: Bitcoin mining is becoming more energy-efficient, utilizing renewable energy and waste gases, and providing grid flexibility.

-

Political Influence:

- ECB: The cryptocurrency industry has undue influence on regulatory policy, skewing it in Bitcoin’s favor.

- Rebuttal: Bitcoin itself is decentralized and leaderless, and the scale of lobbying by traditional financial actors far outweighs that of the nascent industry.

"Unique Implementation of Permanent Primary Deficits" (Federal Reserve Bank of Minneapolis Paper)

In a (seemingly coordinated) display of further ignorance, the Federal Reserve Bank of Minneapolis also released a complementary paper around the same time that extends some of the ideas presented in the ECB economists' paper, particularly around the idea of Bitcoin being a disruptive force to the status quo of fiscal policy.

1. Bitcoin as a Disruptive Element to Fiscal Policy

- Claim: Bitcoin's existence fundamentally challenges a government’s ability to implement a continuous Markov strategy for maintaining permanent primary deficits.

- Support: The authors argue that if Bitcoin (or similar 'useless pieces of paper') is allowed to trade, it creates a continuum of possible equilibria that disrupts fiscal policy, leading to unpredictable economic outcomes.

"If there is trade in bitcoin, then there is no continuous Markov strategy for the government that leads to unique implementation. Instead, there is a continuum of equilibria with distinct real allocations in which the price of bitcoin converges to zero."

2. Balanced Budget Trap

- Claim: Bitcoin introduces a balanced budget trap where government efforts to maintain deficits are thwarted by the presence of Bitcoin, forcing the government to balance its budget.

- Support: The authors explain that when Bitcoin is traded alongside government-issued stock, it creates conditions under which government policies designed for deficits inadvertently result in a balanced budget scenario.

"There is a balanced budget trap: continuous government policies designed for a permanent primary deficit cannot eliminate an alternative steady state in which r - g = 0 and the government is forced to balance its budget."

3. Impact of Prohibiting or Taxing Bitcoin

- Claim: A prohibition or taxation on Bitcoin can restore a government's ability to uniquely implement a permanent primary deficit.

- Support: The authors propose two potential solutions to avoid the economic disruptions caused by Bitcoin—either banning it or imposing a specific tax rate. These measures help eliminate multiple equilibria and maintain fiscal determinacy.

"A legal prohibition against bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on bitcoin at the rate -(r - g) > 0."

4. Fiscal Theory of Price Level and Government Stock

- Claim: Government-issued stock can help maintain price level stability if Bitcoin is restricted.

- Support: The authors draw on fiscal theory to argue that if Bitcoin were absent, government stock could function effectively to stabilize the price level, uniquely implementing a targeted deficit or surplus policy.

"We show that the government can remove the balanced budget trap by running a strictly positive primary surplus when the price of its stock is zero, and running the targeted primary deficit when the price of its stock is consistent with the associated steady state."

5. Nominal vs. Real Policies

- Claim: Purely nominal government policies are inadequate for implementing permanent primary deficits in the presence of Bitcoin.

- Support: The authors argue that nominal policies, such as fixing interest rates or the supply of government stock, fail to achieve unique economic outcomes due to Bitcoin’s disruptive influence, whereas real policies—like running actual surpluses when needed—can restore determinacy.

"Purely nominal policies designed to cover a primary deficit imply a balanced budget trap... Taking the primary surplus to be strictly positive when the price of government stock is zero gives the government the ability to pay a strictly positive flow of dividends."