The Bitcoin Ecosystem: 2024 Annual Report | Epoch VC

Bitcoin Ecosystem Report 2024

By Epoch VC

1. The Evolving Bitcoin Ecosystem

- "Bitcoin’s role in the global economy has continued to expand, with adoption growing across individuals, institutions, and even nation-states. As a monetary network, Bitcoin is increasingly utilized not only as a store of value but as a transactional and financial infrastructure layer, supporting diverse use cases beyond simple peer-to-peer transfers."

- "This report provides an in-depth look at the Bitcoin ecosystem, including its investment landscape, infrastructure developments, and broader macroeconomic implications. We examine Bitcoin's role as both an asset and a protocol and analyze how new innovations are shaping its future utility."

- "Bitcoin’s base layer remains optimized for decentralization and security, but innovations in scaling, programmability, and interoperability are rapidly expanding its functional capabilities."

Bitcoin is transitioning from a simple store of value to a foundational financial network. The report highlights the broadening use cases of Bitcoin, particularly in areas such as payments, financial settlement, and decentralized application infrastructure. Technological advancements in scaling and programmability are crucial in this evolution.

2. The Role of Institutions and Nation-States

- "Major institutions are not just investing in Bitcoin, but integrating it into their treasury strategies, settlement networks, and financial services. The emergence of institutional-grade infrastructure has accelerated Bitcoin’s adoption within traditional finance, with major banks and asset managers now participating in Bitcoin custody, lending, and trading."

- "MicroStrategy remains a leader in corporate Bitcoin adoption, holding a significant portion of Bitcoin on its balance sheet. Other publicly traded companies have followed suit, demonstrating confidence in Bitcoin as a hedge against fiat volatility."

- "Financial institutions are beginning to support Bitcoin's inclusion in portfolio construction. Less than a 1% portfolio allocation to Bitcoin from asset managers would generate over $1 trillion in inflows in the short-term, and passive flows from investing new deposits and portfolio rebalancing. This shift could be imminent."

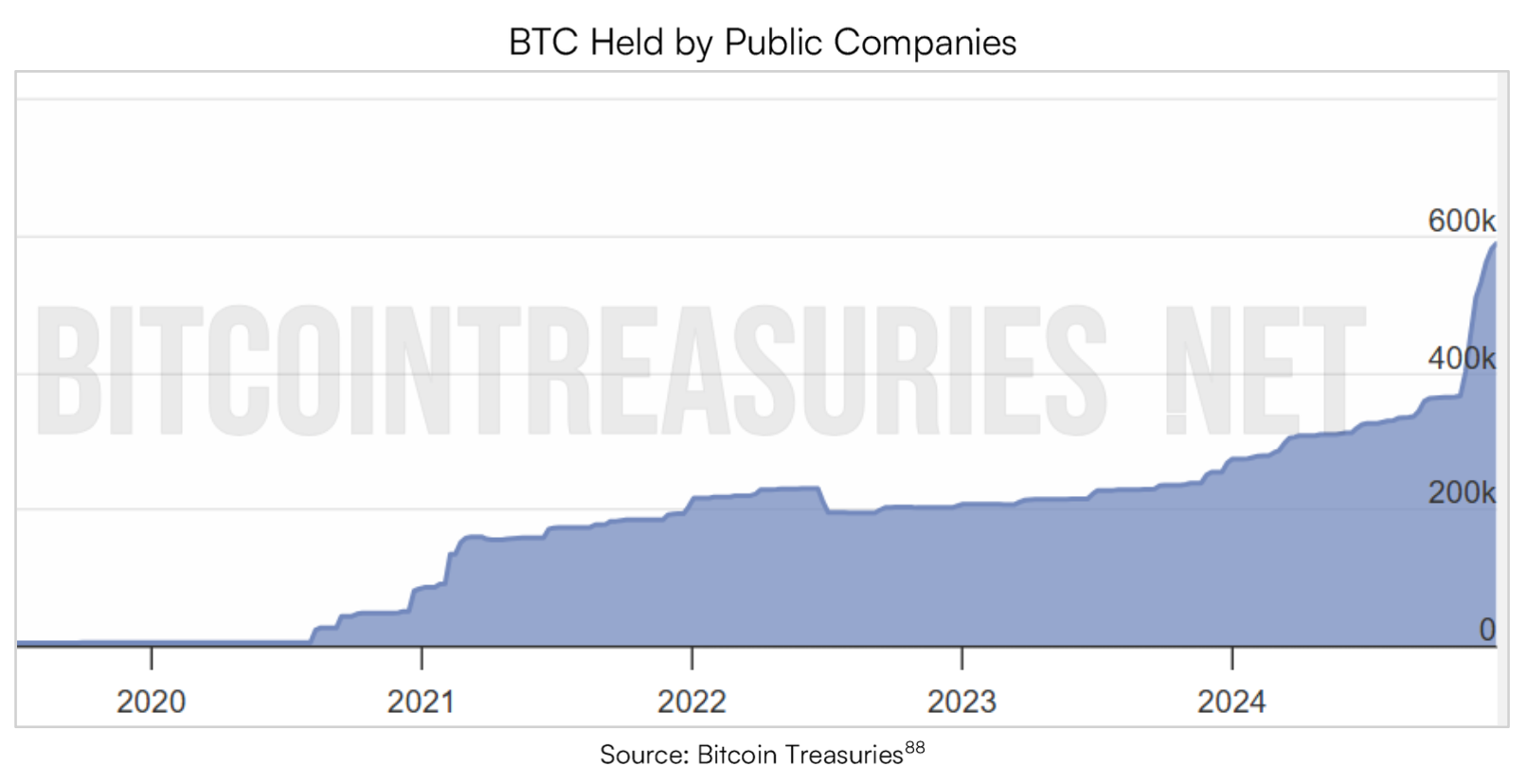

- "In January 2020, 13 public companies held 34,359 BTC compared to 69 public companies holding ~590k BTC at EOY 2024."

- "Businesses built on Bitcoin continue emerging to eliminate infrastructure redundancy, reduce counterparty risk, and lower switching costs in these systems."

- "Countries such as El Salvador have led the way in national Bitcoin adoption, using it for legal tender and treasury reserves. The implications of sovereign Bitcoin adoption are profound, as they challenge the traditional monetary order and introduce new models for nation-state-level financial independence."

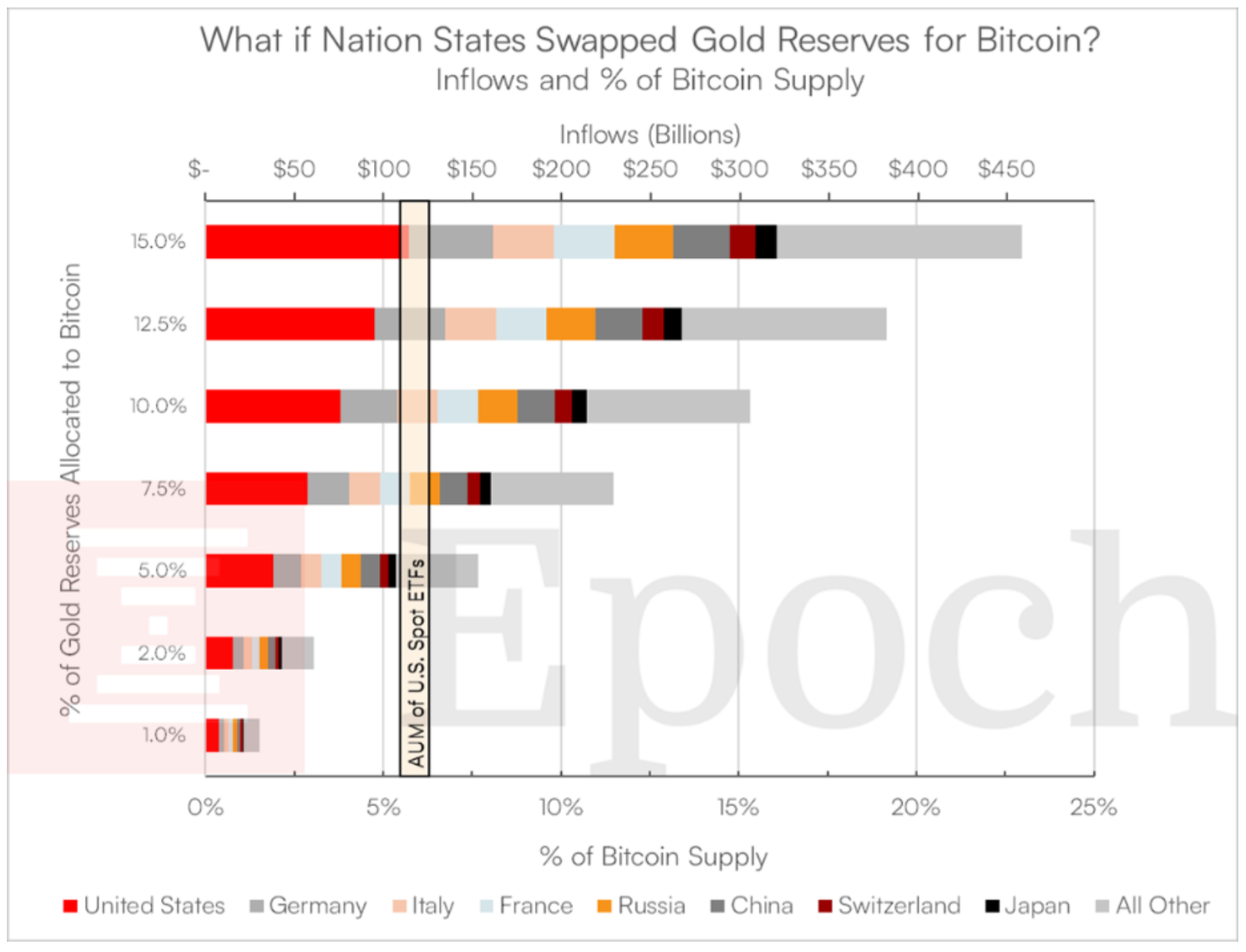

- "If countries sought just a 5% allocation to Bitcoin vs. their gold reserves, Bitcoin would see ~$153bn in inflows. At the current price, this would be ~7.7% of Bitcoin's total supply and ~$35bn greater than the AUM of U.S. spot bitcoin ETFs."

This section underscores Bitcoin's growing importance at the institutional and national level. Beyond speculation, businesses and governments are using Bitcoin as an economic tool. The integration of Bitcoin into settlement networks highlights its potential to serve as a neutral, non-sovereign financial infrastructure.

3. Bitcoin Investment/Adoption Landscape

- "Bitcoin's 'competitors' have learned two lessons: first, don't compete with bitcoin as money because you will lose. Second, allowing a network to process more transactions, or adding more programmability requires network centralization. We anticipate that many projects (no matter their degree of decentralization) will continue to realize that interacting with Bitcoin is the best way to enhance its monetary capabilities."

- "There is a divergence between money flows and adoption metrics because many new cryptocurrency investors chase narratives rather than taking a long term approach towards this industry. Large institutions participate as Bitcoin market makers, adding more liquidity and institutional capital to bitcoin. In contrast, individuals are drawn to new coins that act like a lottery ticket."

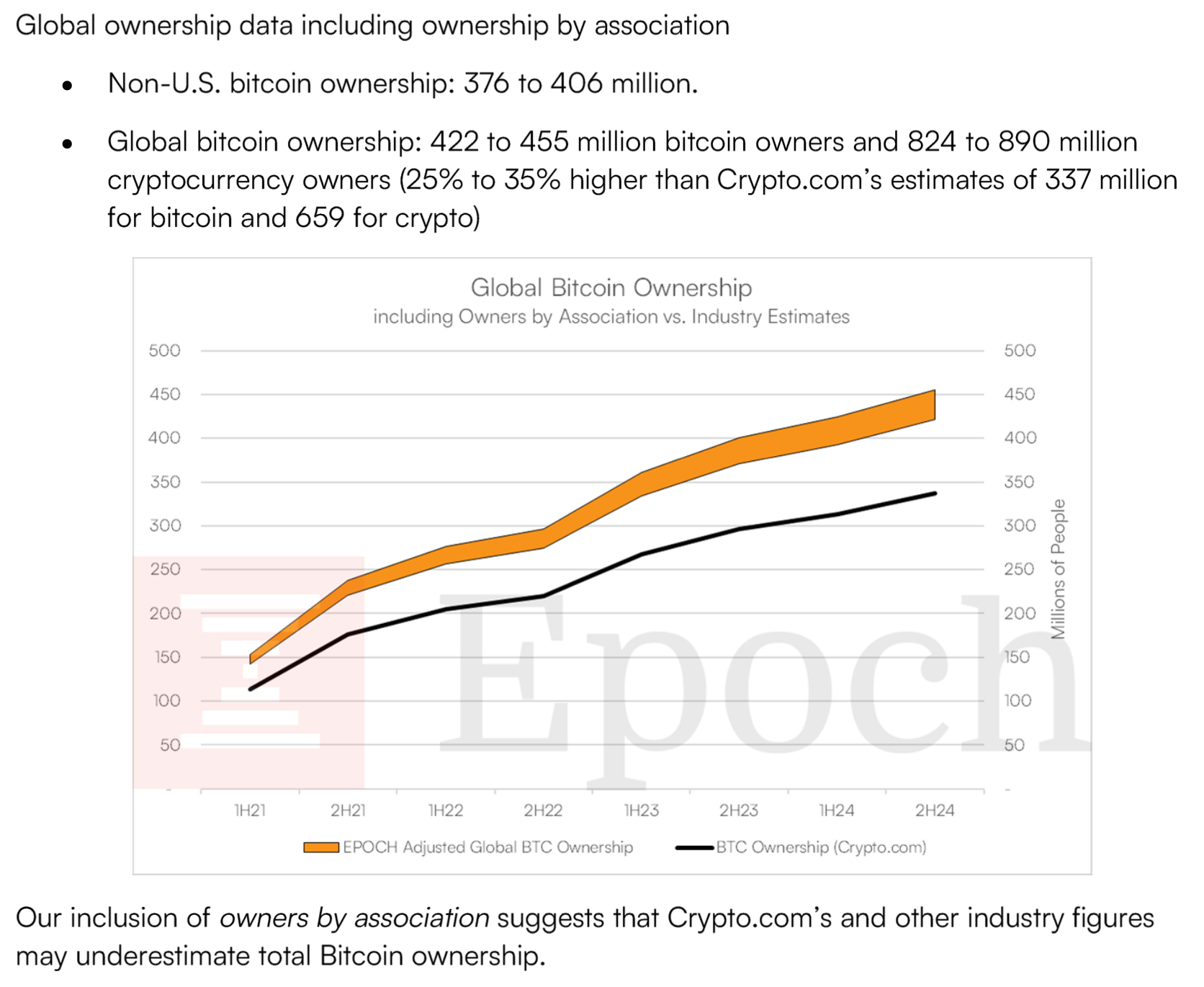

- "Strong price performance, risk-adjusted returns, and the potential use for portfolio diversification has helped drive Bitcoin adoption to more than ~300 million owners worldwide."

- "The growth of Bitcoin ETFs has unlocked institutional capital, providing a regulated and accessible vehicle for investment. Bitcoin ETFs now manage billions in assets, signaling significant demand for Bitcoin exposure through traditional financial instruments."

- "The entrance of traditional financial firms into Bitcoin investment products is a key milestone in the asset’s maturation. With investment giants such as BlackRock and Fidelity offering Bitcoin-related products, mainstream investors now have unprecedented access to the Bitcoin market."

- "On-chain data suggests that long-term holders continue to accumulate Bitcoin, demonstrating strong conviction in its future value. The percentage of Bitcoin supply held by long-term holders has reached new highs, indicating growing confidence in Bitcoin’s long-term security and scarcity."

Regulated investment products, particularly Bitcoin ETFs, have catalyzed Bitcoin's institutional adoption. The report emphasizes that the availability of regulated exposure through ETFs lowers the barriers for traditional investors. Additionally, on-chain metrics suggest that Bitcoin's long-term holder base is strengthening, reducing market volatility over time.

4. Layer 2 Solutions and Infrastructure Growth

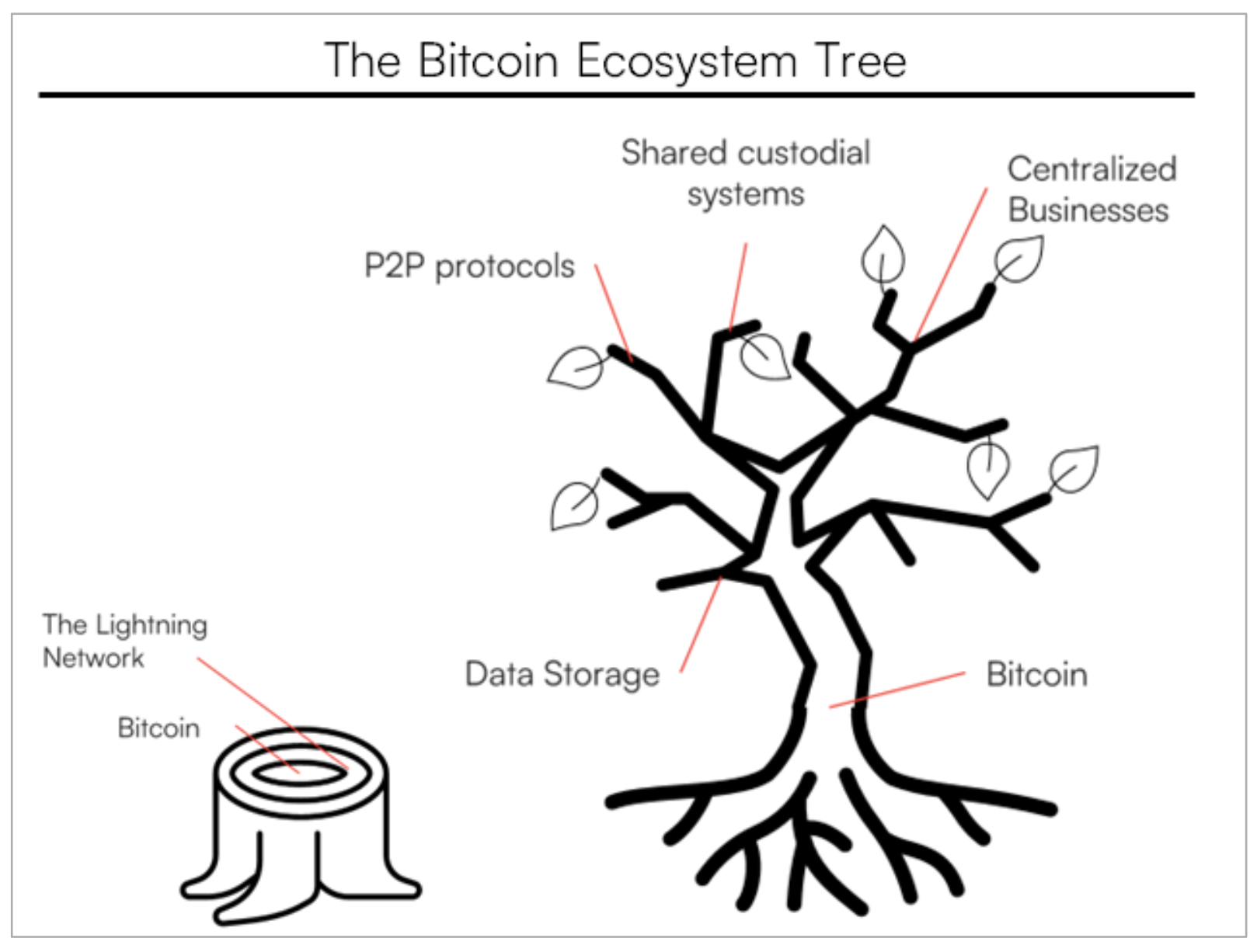

- "Just like the internet and traditional financial systems evolved through layered protocols and applications, Bitcoin - the Internet's native money - follows a similar path."

- "As the Bitcoin L2 ecosystem develops, we expect much of the total value locked and volumes from other blockchains will migrate to Bitcoin for its security properties, monetary value, and disintermediation of infrastructure."

- "We anticipate Bitcoin-native protocol growth to accelerate through its current and upcoming cycles. If Bitcoin's ecosystem expanded to match the proportions of alternative cryptocurrency ecosystems, it could drive approximately 27 times more fee revenue, generate some DEX volume, and increase TVL by roughly 39-fold."

- "The Lightning Network has seen explosive growth, enabling Bitcoin to be used efficiently as a medium of exchange. With sub-second settlement and fees near zero, Lightning is positioned as the most effective scaling solution for Bitcoin payments."

- "Beyond Lightning, emerging Layer 2 solutions such as Fedimint and Ark are broadening Bitcoin’s capabilities. Fedimint offers federated custody with enhanced privacy, while Ark introduces a novel approach to off-chain scaling that minimizes on-chain footprint while enabling seamless transactions."

- "Statechains create novel scaling opportunities, particularly through Lightning channels or Channel Factories. Such a construction would offer exponential scaling of main chain capacity."

- "Bitcoin’s base layer remains optimized for security and decentralization, while Layer 2 networks enhance scalability and transaction efficiency. Innovations in channel management, liquidity provisioning, and cross-network interoperability are making Layer 2 solutions more robust and user-friendly."

The expansion of Bitcoin’s Layer 2 infrastructure is a central theme in the report. Lightning Network growth demonstrates that Bitcoin can function as a global payments network, while alternative Layer 2 solutions enhance privacy and scalability. These advancements enable Bitcoin to be used in a broader range of applications without compromising security.

5. Advances in Bitcoin Smart Contract Constructions and Financial Instruments

- "Bitcoin-related issuers represent approximately 6% of the USD convertible debt market, which is roughly 50 basis points of the entire lending market. As it reaches an inflection point -- Cantor Fitzgerald announced a $2B lending desk for collateralized bitcoin loans in 2024, we expect this market to continue growing and is at an inflection point."

- "We view centralized UX applications that reduce counterparty risk as belonging within the 'goldilocks zone'. Examples of this model include Debifi, Anchorwatch, and Unchained. These firms leverage a unique Bitcoin script, using shared custodial systems, and create user assurances while centralizing their UX and providing direct customer support."

- "While Bitcoin was not designed for complex smart contract execution, innovations such as Discreet Log Contracts (DLCs) and BitVM are enabling more sophisticated financial instruments to be built natively on Bitcoin."

- "Discreet Log Contracts (DLCs) allow for trust-minimized financial agreements using oracles, making it possible to execute derivatives, lending contracts, and prediction markets on Bitcoin without the need for additional tokens or trust assumptions."

- "BitVM introduces a more expressive form of programmability, enabling conditional execution of Bitcoin transactions without requiring a separate scripting environment. This enhances Bitcoin’s flexibility while maintaining its trust-minimized security model."

- "The expansion of Bitcoin’s financial infrastructure is creating new opportunities for decentralized finance (DeFi) applications on Bitcoin, without introducing the risks of centralized or highly experimental alternative blockchains."

- "eCash systems achieve remarkable scaling through network latency and CPU speed limitations, although they bring significant trust tradeoffs."

- "Imagine a world in which users dollar-cost-average into Bitcoin via Ark, join federated custodial solutions, and use eCash as their private cash balance for everyday transactions. Node service providers clear balances through the Lightning Network, with Fedimints and ASPs acting as banking infrastructure. Lightning becomes an institutional clearinghouse in a hub-and-spoke model."

Bitcoin’s programmability is improving with developments such as DLCs and BitVM. These innovations allow for advanced financial contracts without compromising Bitcoin’s core principles of decentralization and security. This represents a shift toward decentralized finance (DeFi) solutions that leverage Bitcoin’s robust security rather than alternative blockchains. Financial instruments are being constructed to minimize trust and risk tradeoffs in a way that is more favorable to consumers.

6. The Impact of Macroeconomic Trends on Bitcoin

- "The inflationary pressures in traditional economies have reinforced Bitcoin’s appeal as a store of value. As fiat currencies continue to experience devaluation, Bitcoin’s fixed supply becomes increasingly attractive to both retail and institutional investors."

- "Central banks’ continued monetary expansion has led to increased interest in Bitcoin as a hedge against fiat devaluation. Historical data suggests that during periods of excessive monetary expansion, Bitcoin experiences significant capital inflows as investors seek non-sovereign alternatives."

- "A growing number of investors now view Bitcoin as digital gold, a non-sovereign asset that offers protection from macroeconomic uncertainty. The parallels between Bitcoin and gold continue to strengthen, particularly in an environment of declining confidence in fiat-based financial systems."

- "Bitcoin’s adoption patterns correlate with periods of economic instability, as capital flows into non-inflationary assets during monetary crises. This trend has been observed across multiple market cycles and continues to be a defining characteristic of Bitcoin’s role in the global financial system."

Macroeconomic conditions continue to drive Bitcoin adoption. The report highlights how inflationary pressures, central bank policies, and declining trust in traditional financial institutions reinforce Bitcoin’s role as a hedge against economic instability.

7. Conclusion: Bitcoin’s Future Outlook

- "Bitcoin is evolving beyond just a speculative asset. It is becoming a critical part of financial markets, payment networks, and national monetary strategies. Its foundational properties—decentralization, scarcity, and security—make it an ideal base-layer monetary network."

- "Bitcoin's base layer remains a bedrock of certainty and security, ensuring the integrity of the monetary supply and transaction immutability."

- "The expansion of Bitcoin’s infrastructure, from investment vehicles to Layer 2 solutions, is accelerating its utility and adoption. As technological advancements continue, Bitcoin’s role in settlement networks, payments, and smart contracts will only grow."

- "Bitcoin’s programmability, scalability, and integration with legacy financial systems are key factors in its long-term adoption. Layer 2 solutions, improved smart contract functionality, and regulatory clarity will further cement Bitcoin’s position as the dominant decentralized financial asset."

- "Bitcoin's scaling future likely exists somewhere between technical and economic approaches. Technical advancements might optimize network structure while economic scaling could leverage a network of service providers using Bitcoin's security."

- "The long-term trajectory of Bitcoin remains strong, with increasing recognition of its role in wealth preservation and global payments. The maturation of Bitcoin’s financial ecosystem will continue to drive both individual and institutional participation in the years ahead."

- "The key to success requires continuous alignment with foundational principles: financial sovereignty, security, and innovating without sacrificing integrity."

Bitcoin is not just an asset but an evolving financial network with broad implications for global finance. With continued improvements in scalability, programmability, and financial integration, Bitcoin is poised to serve as the backbone of a decentralized global economy.