Tether Brings USDt to Bitcoin’s Lightning Network via Taproot Assets

Tether & Taproot Assets

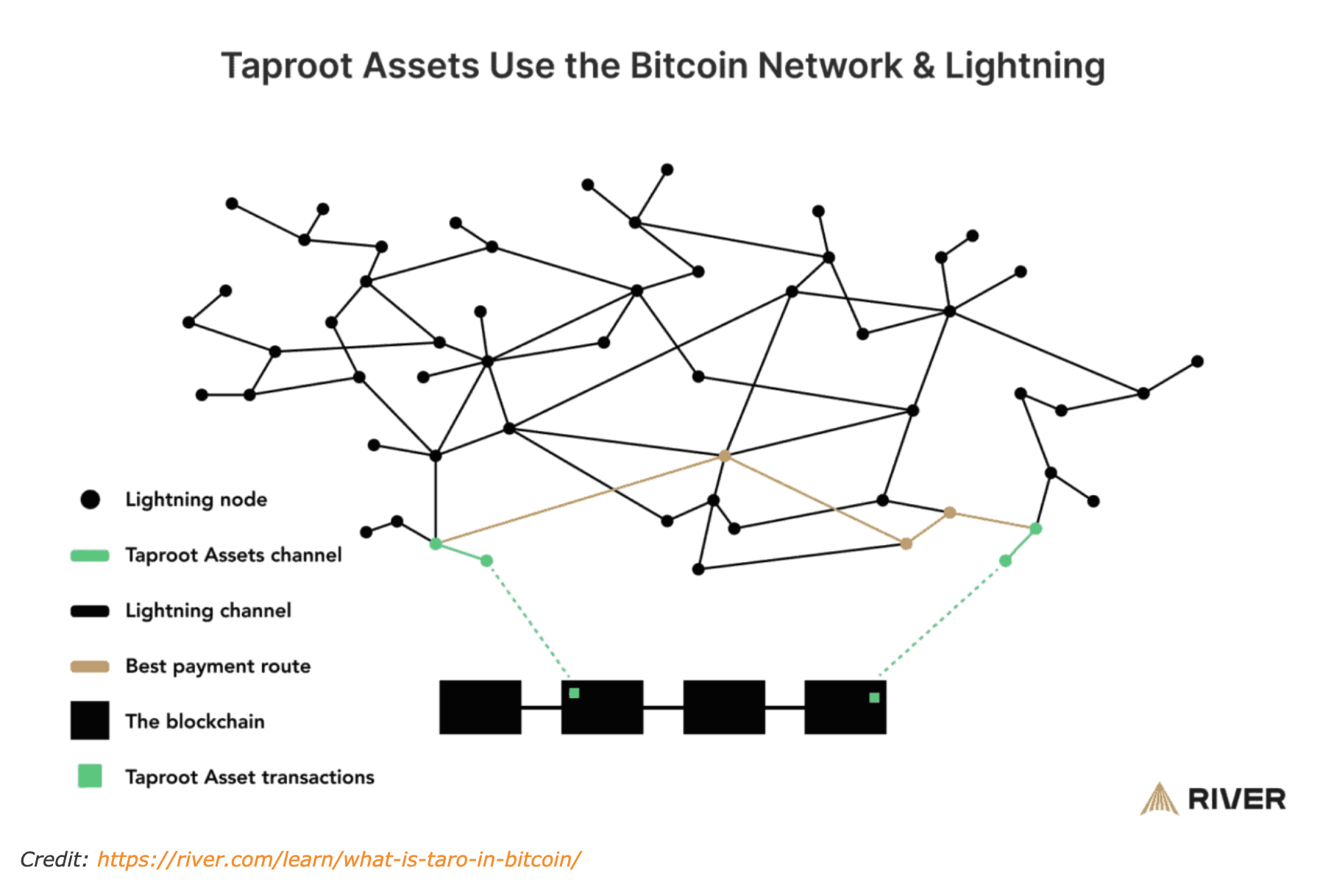

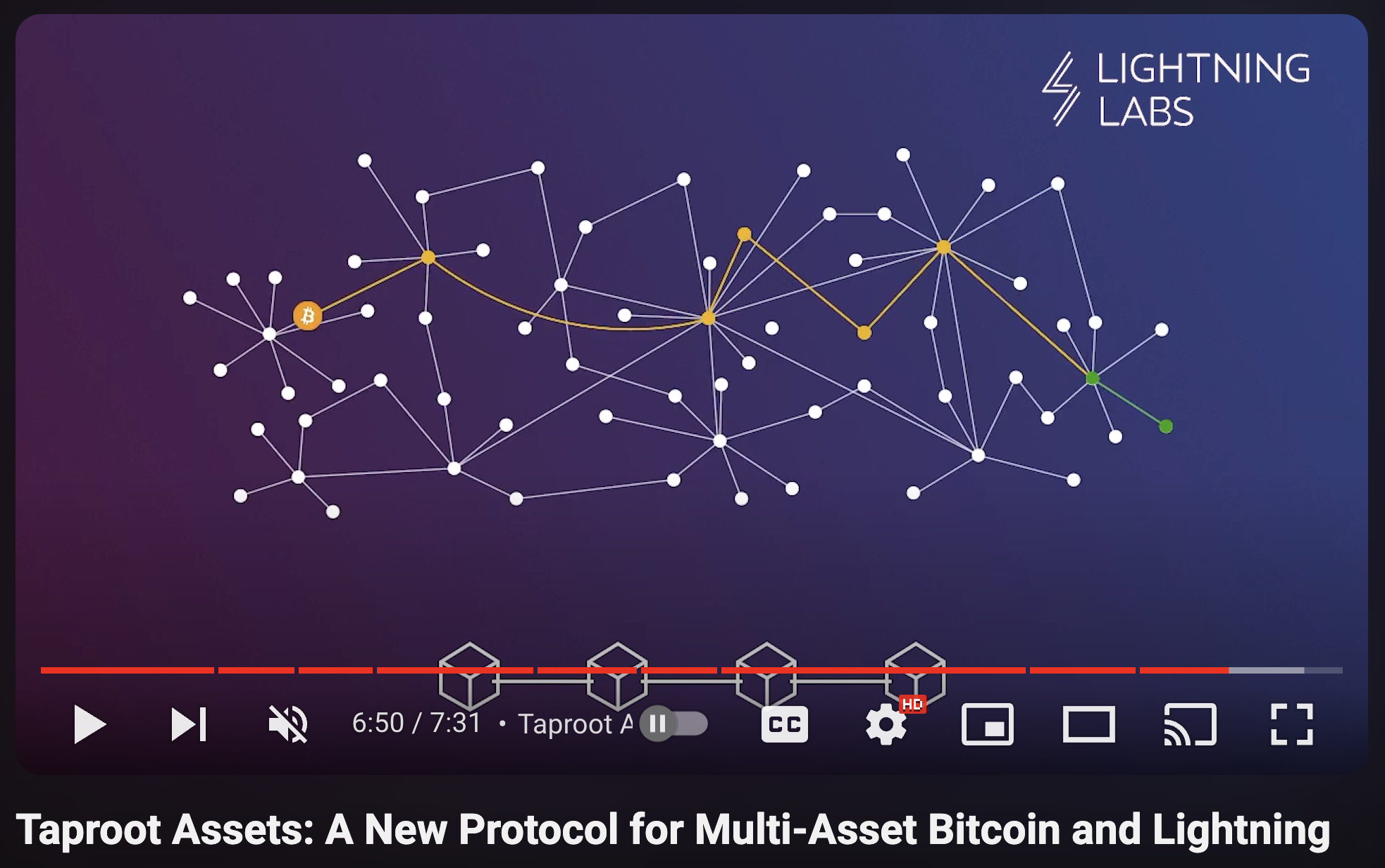

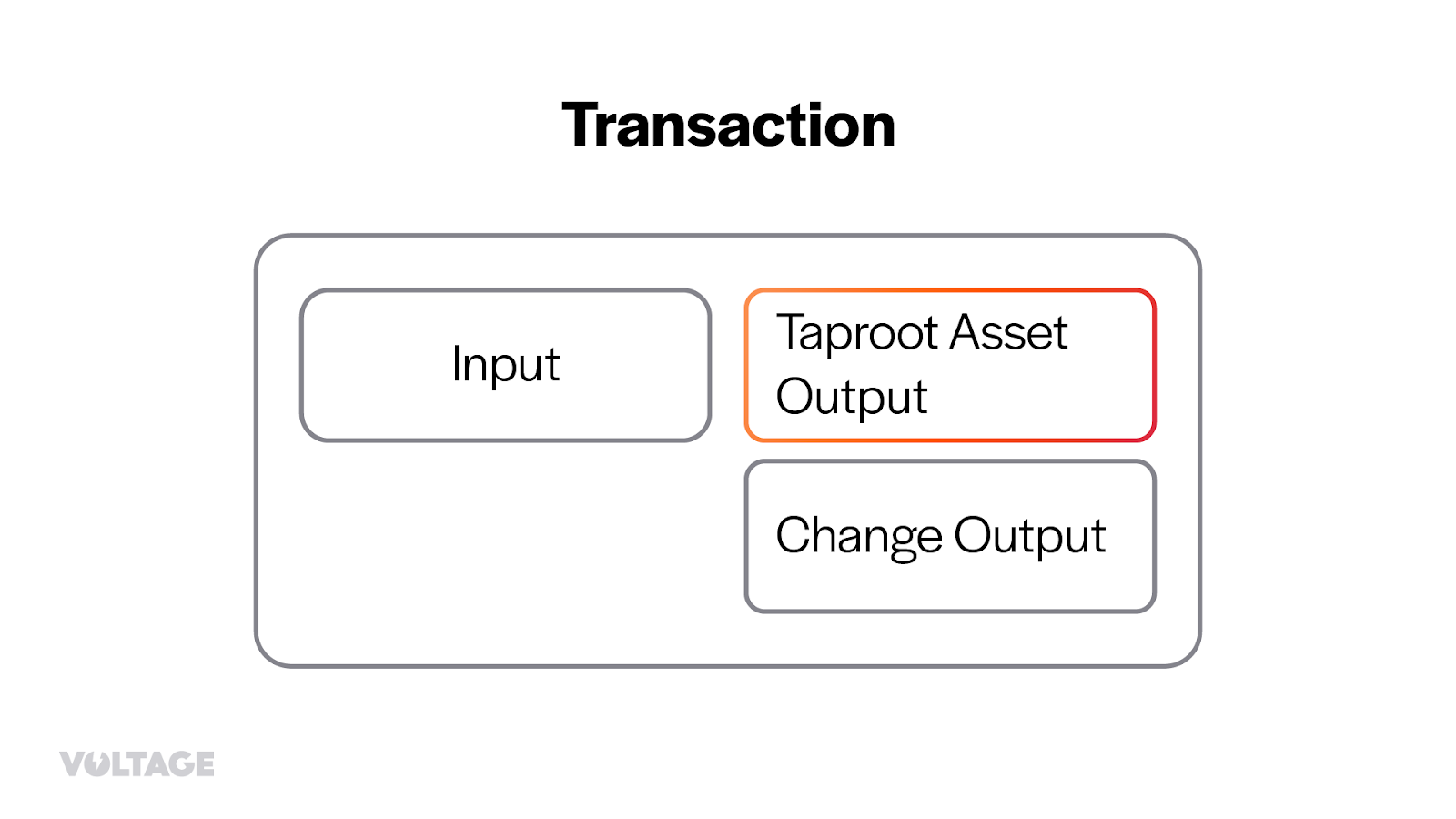

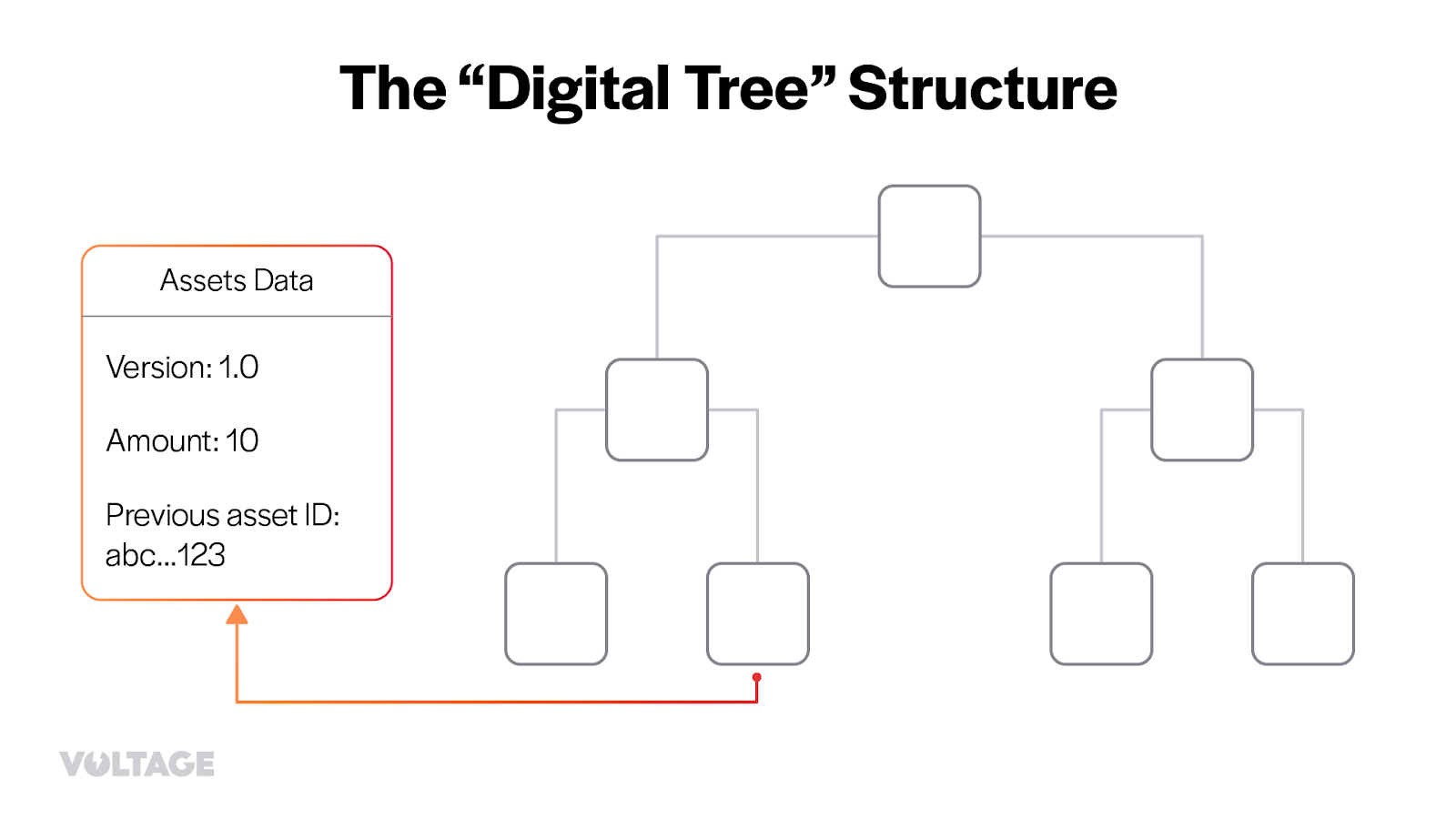

Tether, the largest company in the digital assets industry, announced the integration of USDt into Bitcoin’s ecosystem, including both its base layer and the Lightning Network. Supported by a new Taproot-powered protocol, Taproot Assets, and developed by Lightning Labs, this integration combines Bitcoin’s unmatched decentralization and security with the speed and scalability of the Lightning Network, redefining how stablecoins can function within the Bitcoin ecosystem.

Once fully integrated, USDt will operate seamlessly on Bitcoin’s base layer and its layer 2 Lightning Network. This will enable high-speed, low-cost transactions while combining Bitcoin’s robust security and scalability. With USDt— the world’s largest stablecoin, serving over 350 million users—developers and users will enjoy Bitcoin’s unparalleled reliability alongside the efficiency and versatility of Lightning-enabled payments.

With Bitcoin in high demand among both institutions and retail traders, this integration positions USDt as an essential component of Bitcoin-based financial systems. Taproot Assets enhances Bitcoin’s functionality by enabling support for tokenized assets like USDt while maintaining the blockchain’s decentralized nature. This integration delivers a scalable, seamless payment solution, powering the AI economy and unlocking new use cases, including microtransactions, remittances, and efficient cross-border settlements.

“Tether is committed to driving innovation in the Bitcoin ecosystem,” said Paolo Ardoino, CEO of Tether. “By enabling USDt on the Lightning Network, we are not only reinforcing Bitcoin’s foundational principles of decentralization and security but also creating practical solutions for remittances, payments, and other financial applications that demand both speed and reliability.”

Elizabeth Stark, CEO of Lightning Labs, stated “Today marks a new era for stablecoins. Bringing USDt to Bitcoin combines the security and decentralization of Bitcoin with the speed and scalability of Lightning. Millions of people will now be able to use the most open, secure blockchain to send dollars globally. It all comes back to Bitcoin.”

Tether and Lightning Labs will continue to collaborate to enhance the ecosystem to ensure seamless adoption and robust support for developers and users. As USDt becomes operational on the Lightning Network, this integration is expected to open up new opportunities for Bitcoin’s broader adoption in everyday financial systems.

Tether (USDT) On Lightning

At the end of last month, Lightning Labs announced that it’s bringing USDT to Bitcoin and the Lightning Network via the Taproot Assets protocol.

This upgrade enables Bitcoin service providers to integrate and accept USDT more easily, which Shrader believes will be a boon for Lightning.

“One thing that’s very clear is Tether has product market fit,” said Shrader.

“Last year, it served $10 trillion in payments, which exceeds Visa and MasterCard,” he added.

“It’s very clear that the world wants U.S. dollars.”

Shrader, a pragmatist, acknowledged the fact that many hardline Bitcoiners have issues with USDT running on Bitcoin and Lightning, and he sympathizes with them, as he appreciates that bitcoin’s sound money qualities.

At the same time, he thinks the benefits of having USDT on Lightning clearly outweigh the cons, as many still don’t understand what bitcoin is, nor are they willing to stomach its volatility.

“Many haven’t yet taken the orange pill and come to understand the advantages of bitcoin,” he explained.

“I think bitcoin is an incredible tool, and I want to bring that to as many people as possible. With that said, there are a lot of problems with traditional payments, and Bitcoin has this very secure, auditable system, which is something that I want to bring to the world at scale,” he added.

“While bitcoin’s price action is great for me, a lot of people are afraid of volatility. If you have an asset with very low volatility like USDT, now on very secure, trustless rails, that’s a huge win.”

The Problem That USDT On Lightning Solves

Shrader recounted how the first Bitcoin-related conference MicroStrategy hosted was actually called “Lightning for Corporations.” At the conference, companies were encouraged to start paying employees in bitcoin over Lightning — without fully realizing the troubles this would cause at the time.

“What employers realized was that all of the 1099s that needed to be submitted to employees was a hassle,” said Shrader. “And there was a whole bunch of regulatory overhead that they had to contend with, as well.”

Shrader pointed out that not only can paying employees in USDT over Lightning reduce accounting and regulatory headaches, but it also reduces some of the counterparty risk associated with using banks — a reality with which Shrader is quite familiar.

“Our payroll used to go through Silicon Valley Bank,” said Shrader.

“And, at one point, the payroll provider contacted me to resend my mid-month payroll after I had attempted to pay the staff. I lost half a month’s runway. This was all because of Silicon Valley Bank being insolvent,” he added.

“So, if I can avoid the counterparty risk in the financial system by moving to Bitcoin and Lightning, then that means that I’m in a much better place.”

Author’s note: Some counterparty risk still exists when using USDT, as you have to trust that Tether holds actual U.S. dollars to back the tokenized ones it issues.

The Risks

Shrader noted some of the risks of USDT on Bitcoin and Lightning, but didn’t seem too concerned about them.

“There are some MEV risks when you have assets other than a blockchain’s native asset being traded on-chain,” said Shrader. “But Bitcoin already has Ordinal inscriptions that create other assets, so that problem already exists.”

He also didn’t seem flustered when I brought up the risk of a Bitcoin fork resulting in the USDT on one of the chains becoming worthless, nor did he feel that there’s notable risk of larger economic nodes in the Bitcoin network, like Coinbase, which custodies the bitcoin for the U.S. spot bitcoin ETFs, opting to support a “Tether fork” of Bitcoin, which could also include other upgrades that could hurt Bitcoin in the long run.

“Bitcoin consensus is not determined by custody of bitcoin, so while an important business like Coinbase may support various changes or initiatives, that doesn’t guarantee that protocol changes would be effected,” Shrader said.

Instead of focusing on the risks associated with USDT on Bitcoin, Shrader is doing the opposite.

“What’s more interesting is probably the opportunities that that unlocks where you have actual arbitrage ability on Bitcoin itself,” said Shrader.

“Since every node is capable of transacting in both USDT and bitcoin is also capable of exchanging between them natively on Lightning, you can send bitcoin out of one Lightning channel and receive USDT in another of your Lightning channels,” he added.

“That can be as simple as generating a USDT invoice and paying it with BTC, instantly rebalancing holdings.”